The RSI Advantage

1. RSI Basics: Measure Market Momentum

The Relative Strength Index (RSI) is a momentum oscillator that tracks price speed and changes, helping traders spot potential entry and exit points.

- Scale: 0 to 100

- Key Levels: Above 70 = overbought, Below 30 = oversold

- Think of RSI as a market heartbeat monitor—showing when the market is racing too fast or slowing down.

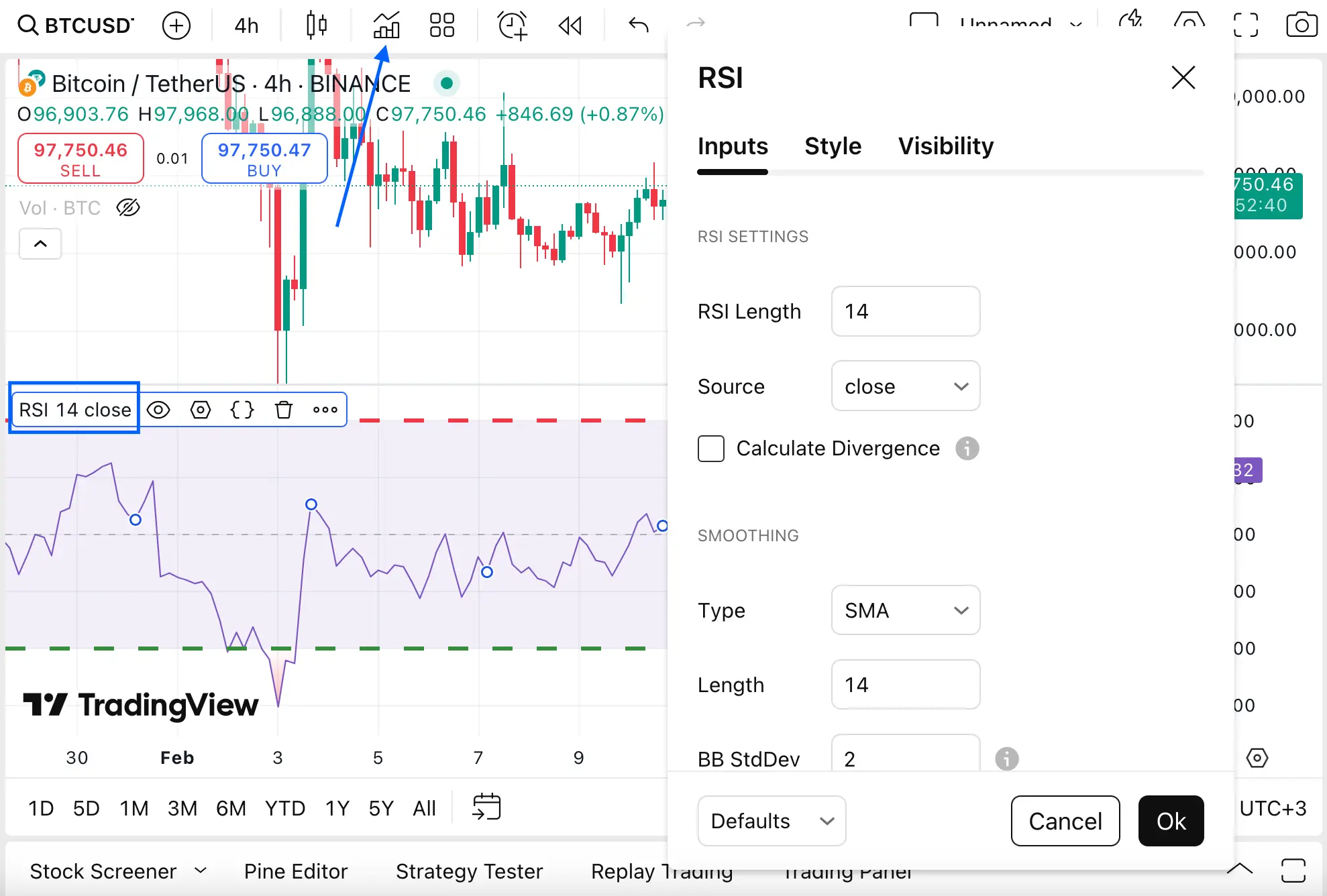

2. Easy RSI Setup

Setting up RSI is simple:

- Navigate to the indicators section on your trading platform.

- Select RSI, and it will overlay onto your chart.

- The default 14-period setting works well, but you can tweak it to fit your strategy.

3. Reading RSI Signals

- Above 70 → Overbought: Potential sell signal.

- Below 30 → Oversold: Potential buy signal.

- Between 30-70: Watch for trend shifts as RSI crosses these key thresholds.

4. Overbought Alerts: When to Sell

An RSI above 70 is a red flag that the market may be overheated. Prices might soon correct, making it a good time to:

✔ Lock in profits on long positions.

✔ Look for short-selling opportunities.

5. Oversold Insights: When to Buy

An RSI below 30 signals that the asset may be undervalued and could soon rebound. Consider:

✔ Entering a buy position if RSI starts moving upward.

✔ Waiting for confirmation before making a move.

6. Trade Execution: Buy & Sell Signals

✅ Bullish Signal: Buy when RSI crosses above 30, indicating a price recovery.

❌ Bearish Signal: Sell when RSI drops below 70, signaling a potential reversal.

Master RSI & Elevate Your Trading

RSI is a powerful tool that helps traders identify market momentum and strategic entry/exit points. Practice using RSI in your trades today and transform your decision-making with data-driven precision! 🚀