CLARITY Act Vote, $1.04B in Spot-ETF Inflows, and Mini-QE in the U.S.

Welcome to our first news digest of 2026!

Here’s what mattered January 12–18: big ETF flows, a postponed U.S. market-structure vote, and shifting liquidity.

Market & Flows

On 01/14, spot crypto ETFs saw the largest single-day net inflow since October — +$1.04B:

- BTC: +$840.6M

- ETH: +$175.1M

- SOL: +$23.6M

- XRP: +$10.63M

A signal of returning institutional liquidity and a constructive tone to kick off 2026.

CLARITY Act — The Key (But Postponed) U.S. Move

The expected Jan 15 markup of the CLARITY Act was delayed. Committee Chair Tim Scott announced a postponement with no new date.

With positions diverging, parts of the industry have pulled public support for the current draft.

In brief, the bill would:

- set clear criteria for what is a security vs a commodity;

- cap stablecoin yields, steering them toward cash-like instruments rather than risk products;

- ban CBDC use by U.S. federal banks;

- reduce legal uncertainty for exchanges and developers.

Sentiment: mixed/neutral. A CBDC ban favors decentralization, while yield caps could cool DeFi liquidity.

Macro: Rates, PPI, and Mini-QE

U.S. PPI rose to 3.0% YoY (vs. 2.7% expected), strengthening the case for a Fed pause at the next decision.

The Administration advanced a $200B MBS purchase plan via Fannie Mae/Freddie Mac. It’s a de-facto targeted QE: lowers yields, cheapens mortgages, and supports risk assets—though full-scale QE is still a way off.

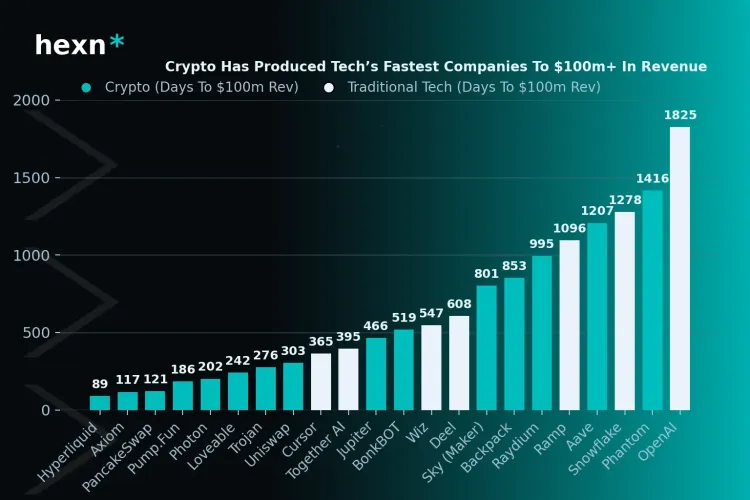

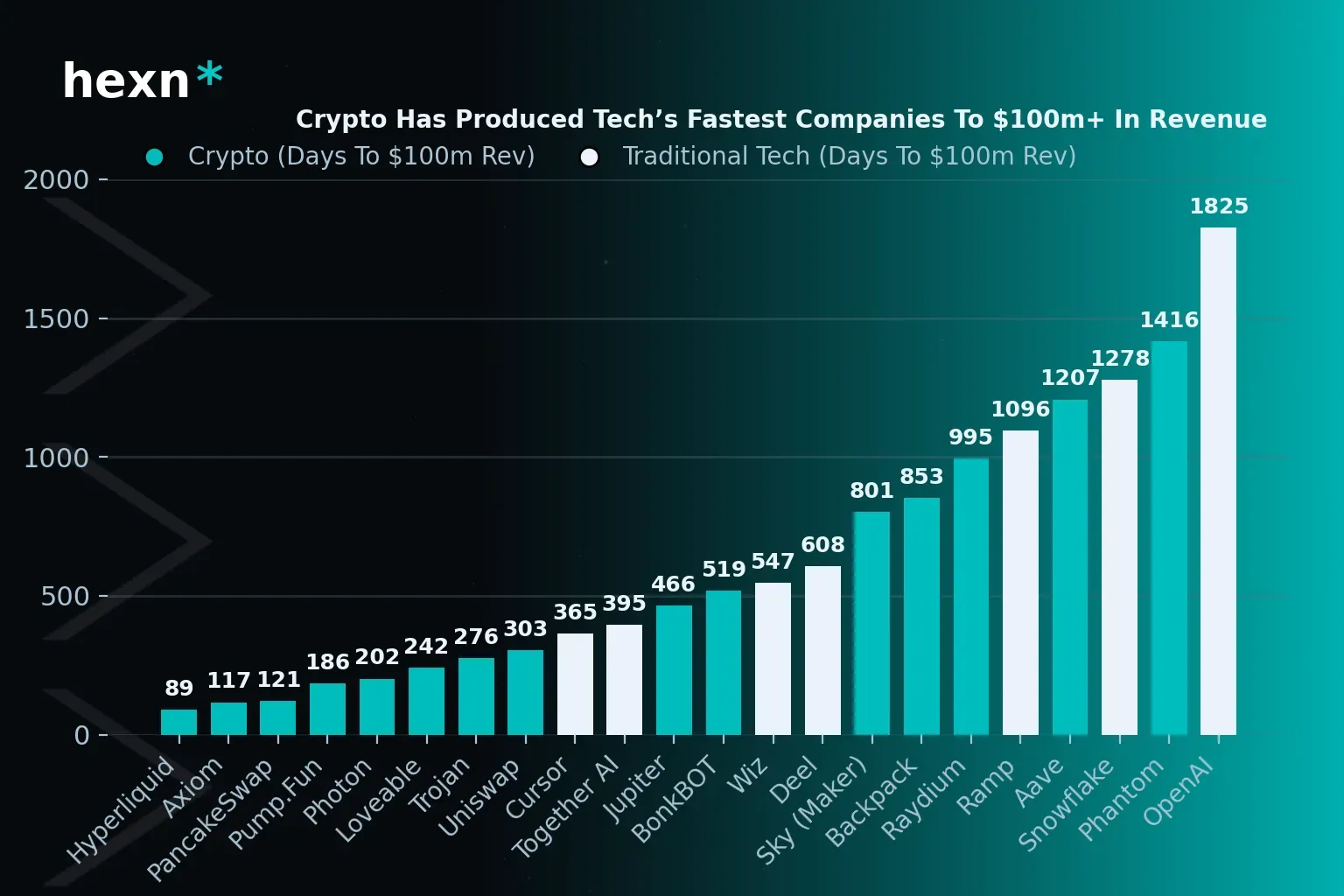

Crypto Keeps the Speed Lead

Industry snapshots show several crypto platforms (e.g., Hyperliquid, Pump.fun) reaching $100M annualized on-chain fees within months—nearly 20× faster than some flagship AI/tech peers.

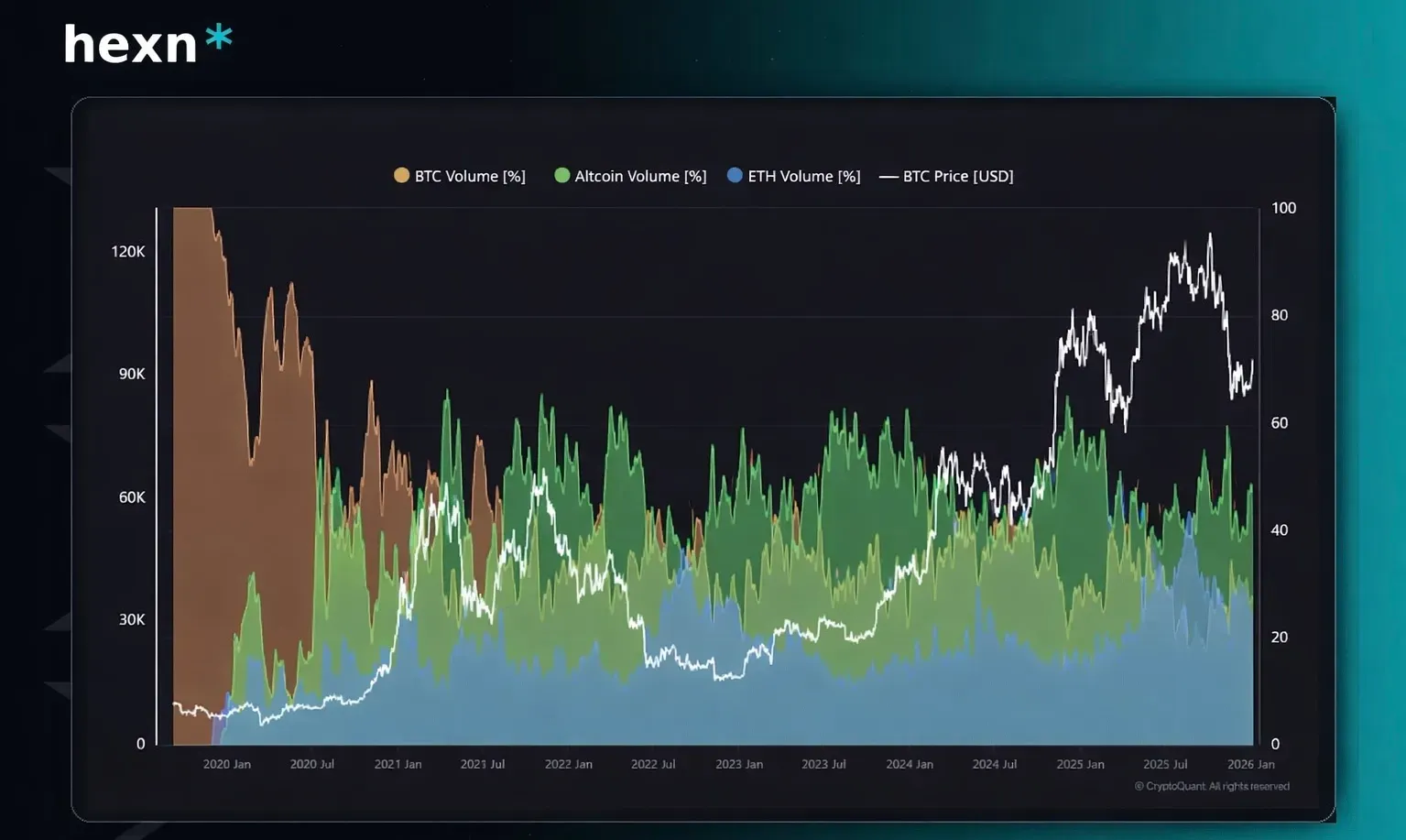

Altseason Coming?

Per CryptoQuant, in Jan 2026 altcoins account for ~50% of total trading volume (BTC ~27%, ETH ~23%)—a sign of rotation and a search for higher beta.

Tickers of the Week

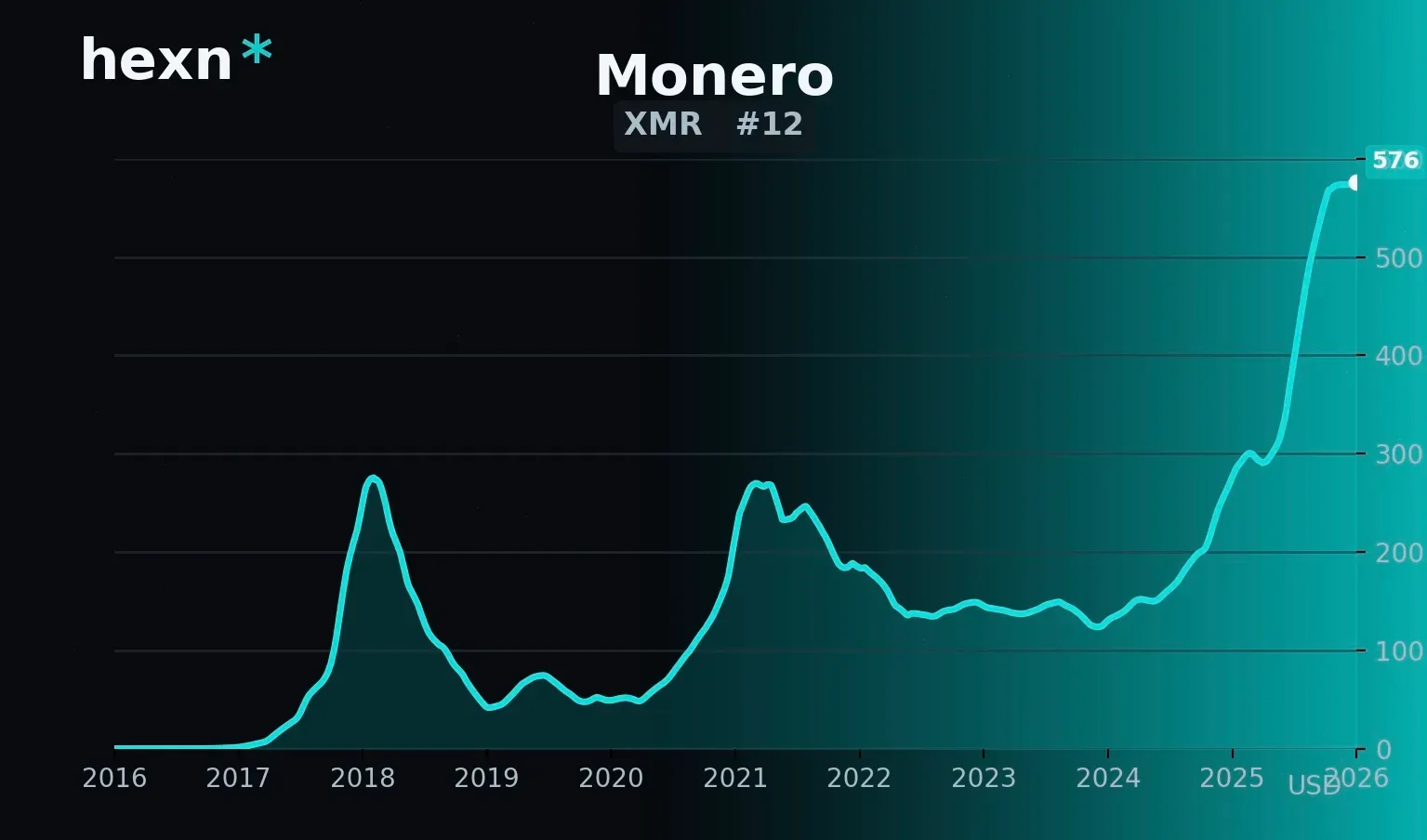

- XMR printed a new ATH — privacy narrative back in focus.

- Bitwise launched a spot Chainlink ETF (ticker CLNK) on NYSE Arca — another bridge from on-chain infra to TradFi.

- CME Group is expanding crypto derivatives with ADA, LINK, and XLM futures.

What This Means for Investors

Short version: liquidity is returning in bursts, and U.S. rules could finally clear a multi-year gray zone.

Near term, macro prints (PPI/rates) still steer the tape, but ETF inflows are a solid tailwind.

Discipline, diversification, and risk controls are must-haves.

How Hexn Helps

HODL: fixed returns up to 20% APY, weekly payouts, flexible terms — smooth volatility while compounding.

Moonrider: need collateralized liquidity? Take multiple loans in one click, earn bonuses and ecosystem points.

Exchange: fast buys/swaps at competitive rates — for precise rebalancing right now.