Is Bitcoin Heading for a New Bottom?

What’s Happening in the Market?

From Thursday night into Friday, Bitcoin broke below $86,000 and briefly dipped under $82,000.

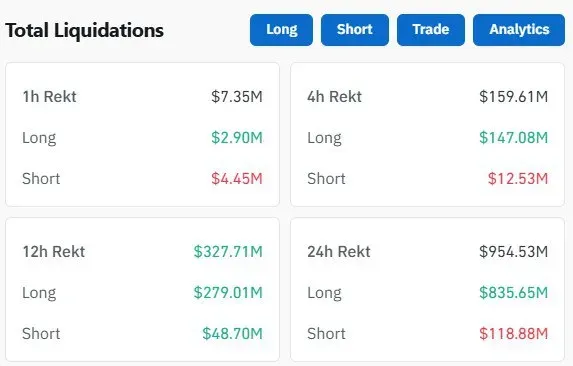

Almost $1 billion worth of derivatives positions were liquidated in 24 hours — with long positions taking the biggest hit.

(Source: CoinGlass)

The CEO of CryptoQuant notes that based on on-chain metrics, the current bull cycle effectively ended when Bitcoin was approaching $100,000. In a classic market cycle, the price often retraces to its realized price (currently around $56,000) to form a bottom.

However, there’s an important caveat: large holders like MicroStrategy, who are unlikely to sell, have effectively removed a significant chunk of supply from circulation. Because of this, he considers a full correction down to $56,000 unlikely — supply is constrained, and the classic cycle model may not play out as cleanly as in previous years.

NVIDIA and the AI “Bubble”

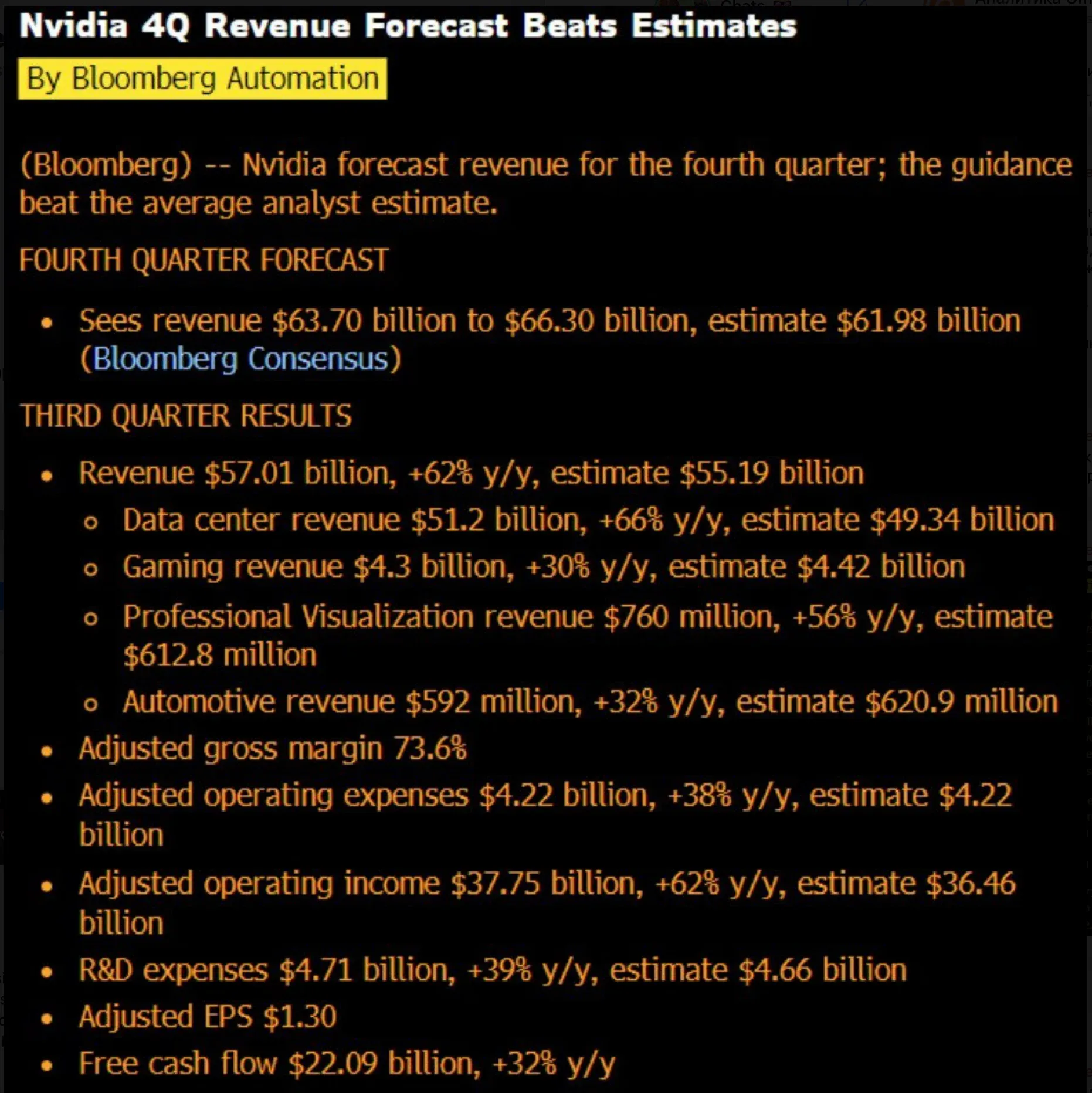

NVIDIA has once again beaten expectations — its latest report showed sharp growth in revenue and data center business. That has, at least for now, cooled down the “AI bubble is bursting” narrative.

For the crypto market, this matters indirectly as a signal of ongoing demand for compute and AI infrastructure.

Against this backdrop, tokens tied to AI and HPC narratives tend to perform better — the market sees that the flow of money into hardware and data centers is still very much alive.

(Source: NVIDIA)

Spot ETF Flows

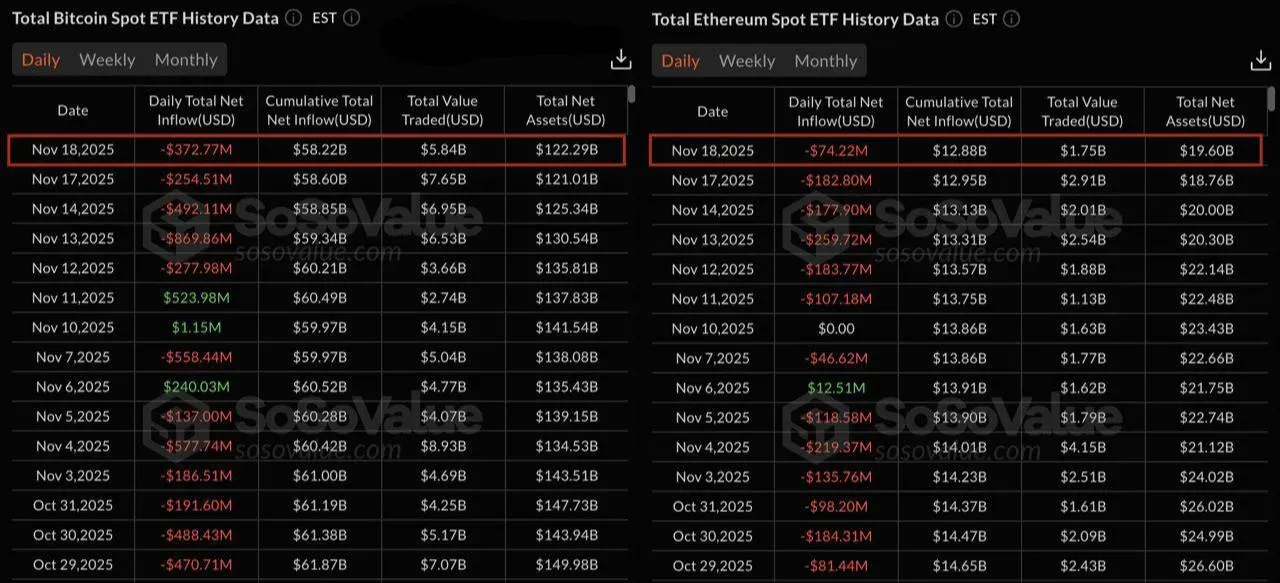

Outflows from US Bitcoin and Ethereum ETFs are ongoing.

(Source: Sosovalue)

On November 19, the iShares Bitcoin Trust (IBIT) recorded a single-day record outflow of around $750 million.

A series of such outflow days increases intraday volatility and widens spreads.

Hashed CEO Simon Kim notes that the current downtrend is fundamentally different from previous ones: instead of existential fear about crypto’s future, we’re seeing evolving regulation and growing institutional participation.

Weekly Takeaway

- The market went through a sharp Bitcoin flush-out, but a full move down to the “realized price” is not widely expected for now.

- The broader macro picture is supported by strong earnings from tech giants like NVIDIA — demand for compute and AI remains a key risk-on driver.

- Market structure keeps maturing: through ETF flows on one side and new derivatives on traditional exchanges on the other.

Don’t panic and stay tuned.