$19B+ in Liquidations in 24 Hours: Who Won, Who Lost, and What’s Next

Introduction

October has been one of the most turbulent months for crypto in 2025.

After weeks of optimism and record inflows into Bitcoin ETFs, the market faced a brutal correction — a reminder that volatility never truly disappears, it only hides between rallies.

Between October 10 and 11, more than $19 billion in leveraged positions were liquidated in less than 24 hours, making it the largest market reset of the year.

Here’s a breakdown of what happened, who came out on top, and what this means for investors moving forward.

What Happened

On the night of October 10–11, the crypto market experienced a massive cascade of liquidations.

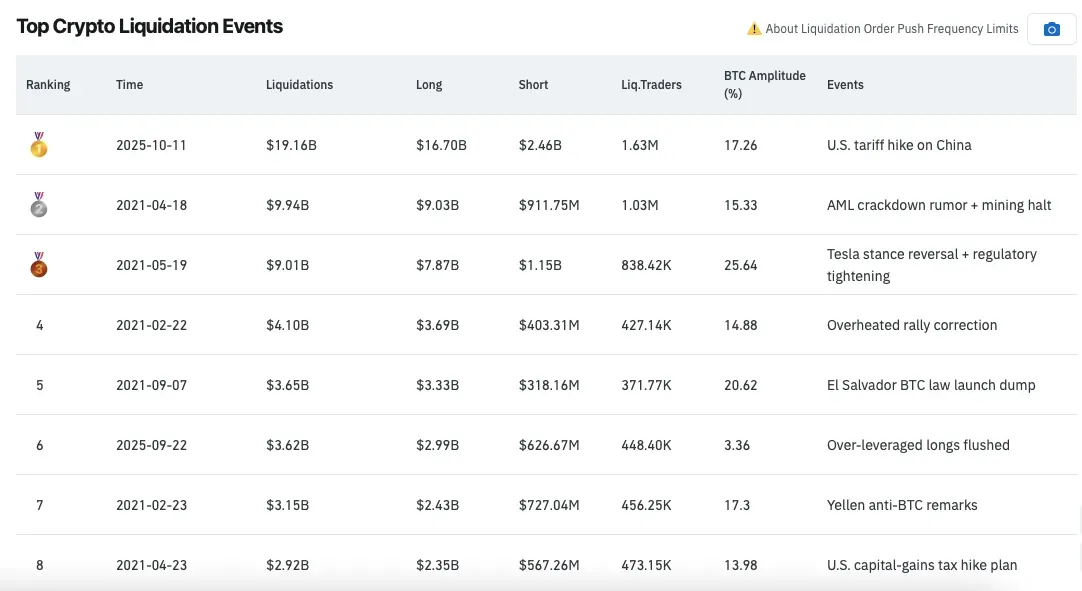

According to CoinGlass, the total exceeded $19 billion.

The main reason? Unrealistic market expectations. Many traders and funds were expecting a strong Q4 rally — fueled by institutional inflows and Bitcoin ETF optimism.

But instead of sustained growth, the market saw a sudden correction.

A large share of institutional capital had entered low-liquidity altcoins with high leverage, creating the perfect setup for a chain reaction once prices started to fall.

When the first margin calls hit, liquidations spread like wildfire across the market — a classic domino effect that wiped out over a million trading accounts.

(Source: CoinGlass)

(Source: CoinGlass)

Who Made Money

Amid the chaos, a few managed to profit.

One standout was Garrett, a well-known crypto trader and former BitForex executive.

Roughly 30 minutes before the sell-off began, he opened a large short position on the Hyperliquid exchange — earning about $192 million as the market collapsed.

He later confirmed that his move was based on signs of overheating and excessive leverage.

Currently, Garrett holds moderately bearish positions on BTC and ETH, suggesting he expects further volatility ahead.

Who Lost

The crash hit market makers and funds the hardest:

- ABC, one of Hyperliquid’s largest market makers, lost over $35 million, erasing 73% of its trading balance.

- Cyantarb, another key player, was forced to close around $100 million in leveraged positions, realizing $18–19 million in losses.

- Selini Capital, a derivatives-focused hedge fund, lost $50–70 million, including $16 million overnight.

- Several altcoins — including ATOM, RVN, and IOTX — briefly traded near zero on derivatives markets.

In total, more than 1.6 million accounts were liquidated — most of them long positions with excessive leverage.

(Top daily user losses on Hyperliquid)

What Experts Say

According to Glassnode’s Week On-Chain Report (Week 40, 2025), roughly 97% of Bitcoin’s circulating supply was in profit before the crash — a level that has historically preceded major corrections.

Glassnode analysts described the event as a “natural market reset” after months of sustained inflows and speculative positioning.

They noted that Bitcoin’s rally to $126,000 was supported mainly by $2.2 billion in ETF inflows and consistent accumulation by smaller holders, rather than whale-driven speculation.

In short, the correction may have been painful, but it helped flush out excessive leverage and restore balance to the market.

(Source: Glassnode Week On-Chain — Week 40, 2025)

Binance Allocates $400M to Support Users

Following the crash, Binance announced The Together Initiative, a $400 million recovery fund to help affected users and stabilize market confidence.

- $300 million will go toward compensating retail traders whose positions were liquidated on October 10–11.

- $100 million will fund low-interest loans for institutional clients and ecosystem projects.

The exchange clarified that it bears no legal responsibility for user losses but views these measures as part of a broader effort to restore trust and market stability.

Takeaway

The market hasn’t fully recovered yet — volatility remains high, and sentiment is cautious.

Despite a partial rebound in spot prices, derivatives activity is still elevated, suggesting that traders are not done with risk-taking just yet.

Another correction is possible if new macro or regulatory pressure emerges.

The lesson is simple but crucial: high leverage in illiquid assets can be devastating — even for professionals.

If your goal is to preserve capital and earn predictable returns without taking unnecessary risks, this might be the moment to explore fixed-income opportunities.

Hexn offers deposits with returns up to 20% APY — no leverage, no stress, and weekly interest payouts.

Stay smart. Stay safe. With Hexn.