Weekly News Digest: ETF Flows, RWA Growth & U.S. Crypto Policy

The crypto market is slowly finding its balance after the October 10–11 sell-off.

Despite ongoing volatility, institutional activity remains strong — showing that big players are still in the game.

Here are five signals that reveal where capital is moving and how the structure of the digital asset market is changing.

1. Investment Funds Pulled $513M from ETPs in a Week

According to CoinShares, digital asset investment products (ETPs) saw $513 million in outflows following the mid-October crash.

However, regional flows tell a different story: Germany, Switzerland, and Canada still recorded inflows.

This suggests that investors are not abandoning crypto exposure — they’re rebalancing portfolios after a period of strong growth.

(Source: CoinShares)

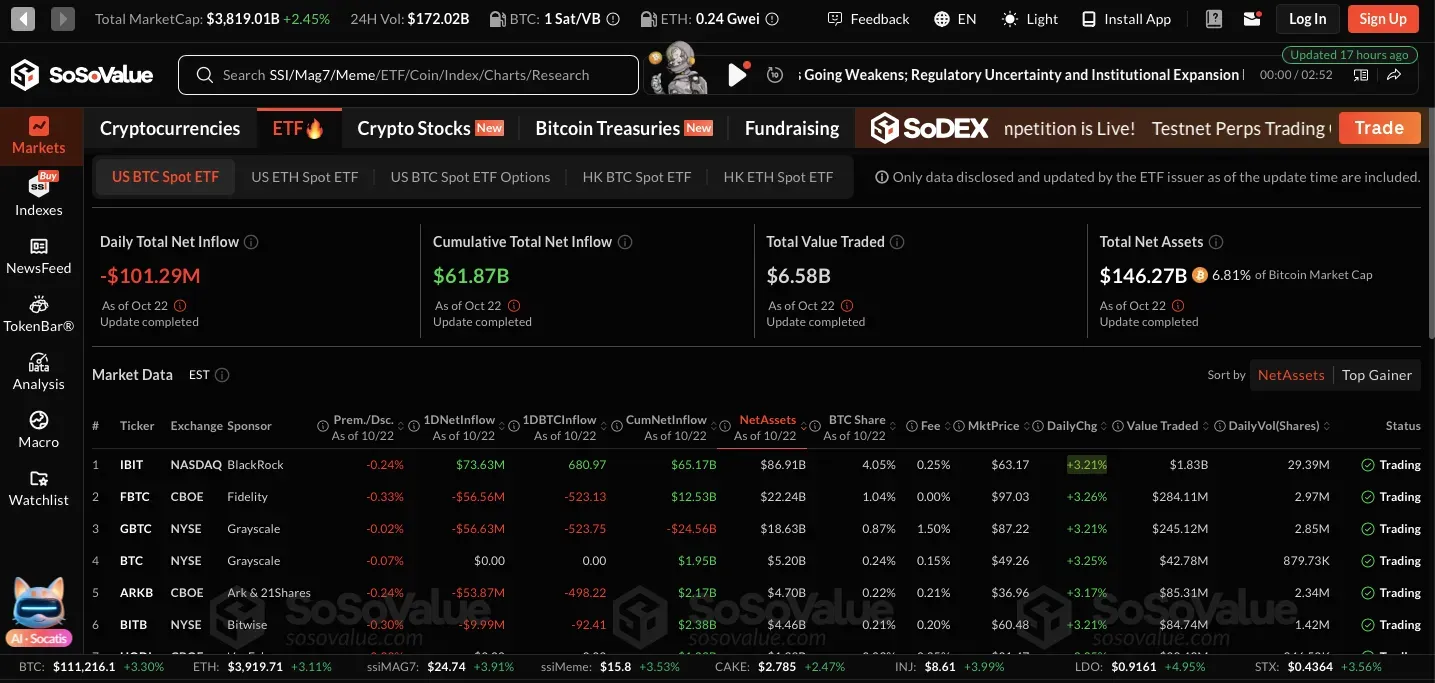

2. Major Outflows from ETH and BTC ETFs — $246M

Data from SoSoValue shows combined outflows of $246 million from Ethereum and Bitcoin spot ETFs this week.

Ethereum funds saw −$145.6 million, while Bitcoin ETFs recorded −$101.3 million.

Notably, the BlackRock IBIT ETF bucked the trend with a small inflow.

These moves are largely profit-taking, not panic selling. Long-term holders are realizing gains after months of steady uptrend.

Analysts expect that Q4 will remain strong for both BTC and ETH, as institutional demand continues to build momentum.

(Source: SoSoValue)

3. Tokenized Assets (RWA) Market Surpasses $30B

The latest reports from Messari and InvestaX show that the Real-World Asset (RWA) market has now exceeded $30 billion in total value.

(Source: InvestaX)

RWA has become one of the most important growth stories of 2025, signaling that blockchain is evolving from speculation to financial infrastructure.

Analysts from Keyrock predict that the RWA market could reach $50 billion by 2026, driven by the tokenization of treasury bills, real estate, and private credit.

(Источник: Keyrock)

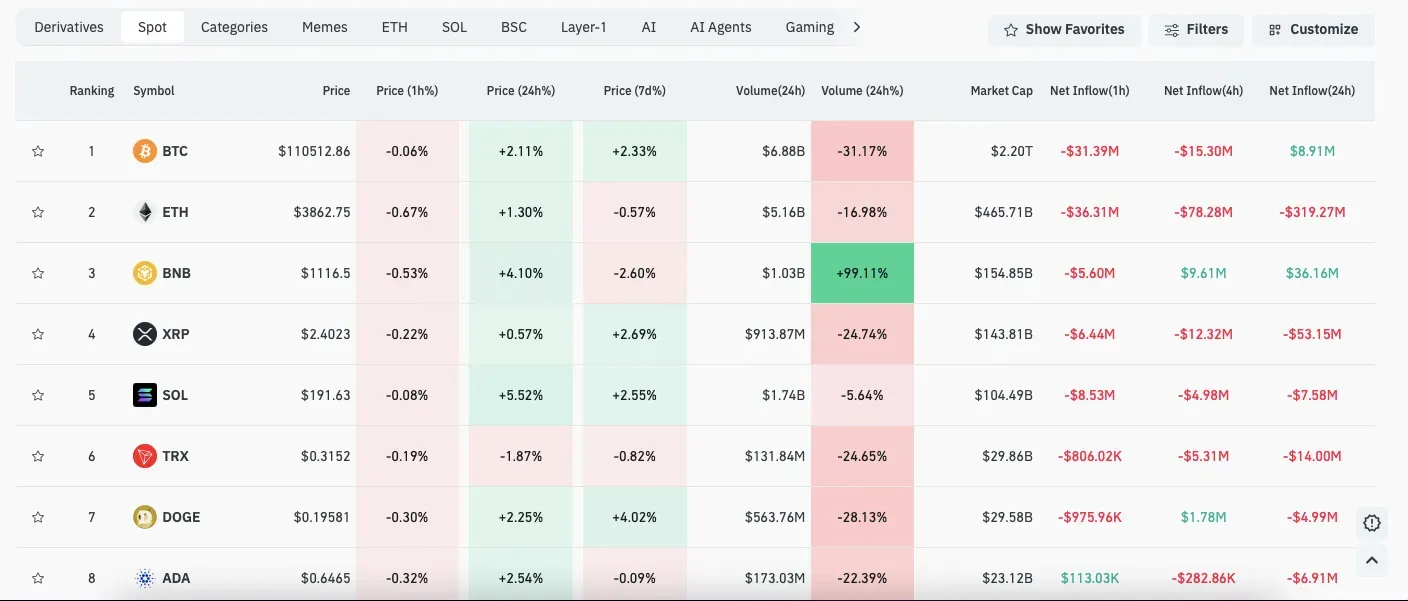

4. U.S.: Trump Pardons CZ

On October 23, U.S. President Donald Trump pardoned Binance founder Changpeng Zhao (CZ), previously convicted of AML-related charges.

The news sparked a wave of volatility: BNB rallied ahead of the announcement and briefly corrected afterward as traders took profits.

Market observers see the move as a political gesture, possibly indicating a softer stance toward the crypto industry — though no structural policy shift has occurred yet.

(Source: Coinglass)

5. Gold Hits an All-Time High — $4,200 per Ounce

According to Reuters, gold prices broke $4,200 per ounce for the first time in history.

The rally was fueled by geopolitical risks, expectations of Fed rate cuts, and a weaker U.S. dollar.

While crypto remains volatile, many institutional investors are hedging with traditional safe-haven assets — a reminder that risk diversification remains key.

What It Means for Investors

The market is entering a capital redistribution phase.

Institutional investors are locking in profits in ETFs while seeking new entry points in emerging areas like infrastructure and tokenized assets (RWA).

In such conditions, stable-yield products stand out as one of the most reliable ways to preserve and grow capital.

With Hexn, you can earn up to 20% APY on your crypto — paid out weekly, with no leverage and no stress.